Call 1300 936 560 for a no obligation quote – enquire today!

Austrata Hybrid Loan®

How It Works

- Owners can pay their share upfront to avoid strata loan interest.

- Other owners can repay their share over time through a strata loan.

This structure allows for flexibility, ensuring that owners who prefer a lump sum payment can save on interest, while others have the option to pay over time.

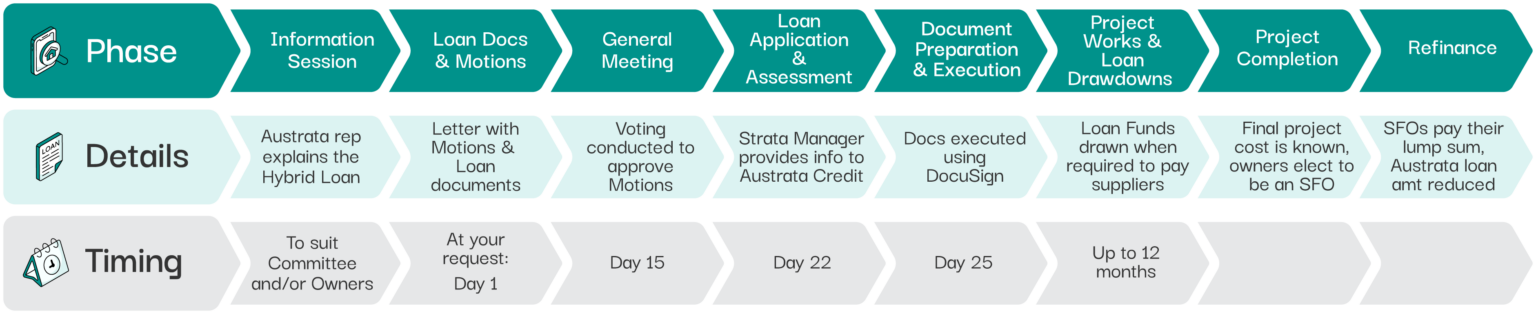

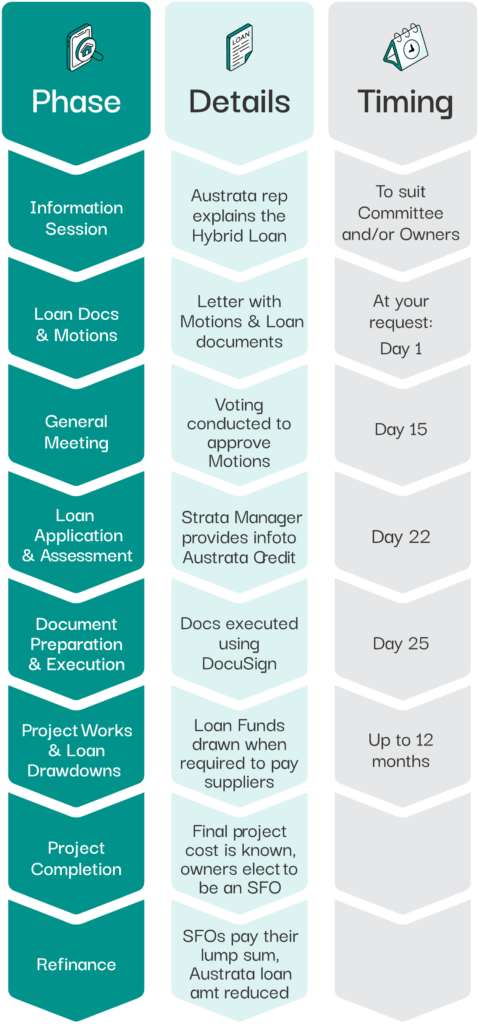

Simple & Easy Process

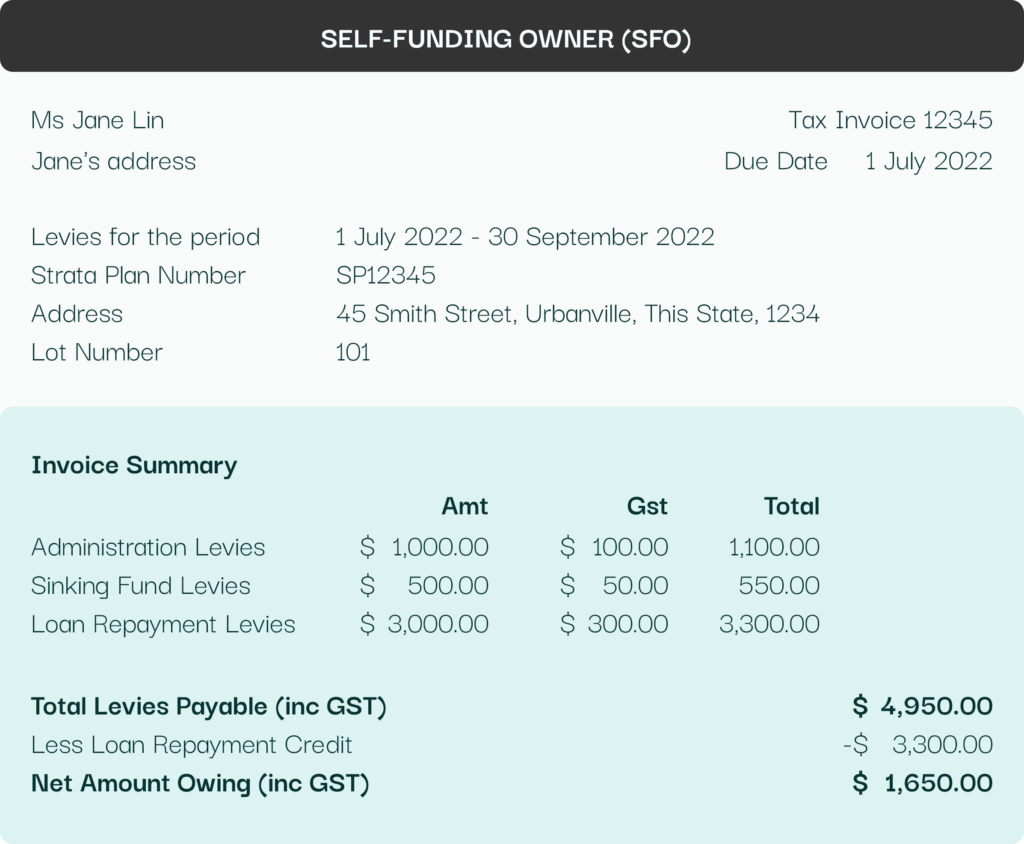

How Much Do I Pay if I Want to Become a Self-Funding Owner (SFO)?

Understanding Levies

SELF-FUNDING OWNER (SFO)

Levies for the period

Strata Plan Number

Address

Lot Number

1 July 2022 – 30 September 2022

SP12345

45 Smith Street, Urbanville, This State, 1234

101

| Amt | Gst | Total | |

|---|---|---|---|

| Administration Levies | $ 1,000.00 | $ 100.00 | $ 1,100.00 |

| Sinking Fund Levies | $ 500.00 | $ 50.00 | $ 550.00 |

| Loan Repayment Levies | $ 3,000.00 | $ 300.00 | $ 3,300.00 |

Total Levies Payable (inc GST)

Less Loan Repayment Credit

Net Amount Owing (inc GST)

$ 4,950.00

-$ 3,300.00

$ 1,650.00

NON-SFO

Levies for the period

Strata Plan Number

Address

Lot Number

1 July 2022 – 30 September 2022

SP12345

45 Smith Street, Urbanville, This State, 1234

102

| Amt | Gst | Total | |

|---|---|---|---|

| Administration Levies | $ 1,000.00 | $ 100.00 | $ 1,100.00 |

| Sinking Fund Levies | $ 500.00 | $ 50.00 | $ 550.00 |

| Loan Repayment Levies | $ 3,000.00 | $ 300.00 | $ 3,300.00 |

Total Levies Payable (inc GST)

$ 4,950.00

Frequently asked questions

The Hybrid Loan allows some owners to pay their share of a project cost as a lump sum, avoiding paying interest on a loan, whilst other owners pay their share of a project cost over the life of the loan.

Where a program of works is expected to run over an extended period, and the program consists of multiple discrete projects (e.g., replacement of windows and also the upgrade of balconies/balustrades), then with your Strata Manager’s consent it may be possible to utilise a combination of a Hybrid Loan with one or more Standard Loans.

Yes, Austrata typically includes an allowance for variations for unforeseen expenses that may arise during the project works.

The Hybrid Loan is an amortising loan product, not a come-and-go line of credit facility, albeit it can be subject to multiple progress draws.

The interest rate is variable.

If the full amount is not required, the Strata Manager will advise Austrata, and loan repayments will be structured accordingly.

Each SFO will be charged Loan Repayment Levies to pay for its proportion of the loan repayments, but these levies charged will be offset by the loan repayments owed to each SFO by the OC/BC.

There are no additional costs or payments for SFOs pertaining to loan repayments.

All lot/unit owners are responsible for all loan repayments made by the OC/BC, whether for the Austrata loan or the SFO loans.

Each SFO effectively “pays” its share of the loan interest on the Total Amount borrowed with the “proceeds” of the loan repayment it receives from the OC/BC.

Only those owners at the time when the project is complete can become an SFO.

An incoming purchaser who buys a lot/unit from an existing SFO can become an SFO, achieved by way of the SFO Agreement being assigned from the original SFO to the purchaser.

An incoming purchaser who buys a lot/unit from a “non-SFO” does not have the option to become an SFO.

All lot/unit owners are charged Loan Repayment Levies by the OC/BC in accordance with the lot/unit owner’s share of your OC/BC.

SFOs are charged Loan Repayment Levies in accordance with their lot/unit entitlement (or unit entitlement) percentage, but these levies are offset by the loan repayments due to them from the OC/BC under the SFO loan.

Non-SFOs are charged Loan Repayment Levies in accordance with their lot/unit entitlement percentage and must pay these levies in the normal stipulated timeframe.

Austrata keeps a ledger of all levies charged and all loan repayments, allowing it to automatically calculate any difference that may arise during the year.

If there is a material change in the loan repayments, shortly before the next AGM, Austrata will calculate the levies to meet the expected loan repayments in the upcoming year, will adjust this based on any difference in the current year and will communicate this to the Strata Manager.

If the interest rate changes on Austrata’s loan, then the interest rate on each SFO loan will also automatically change under the terms of the SFO loan.

This means that the OC/BC ’s total loan repayments will go up (if rates go up) or down (if rates go down), all lot/unit owners will be charged higher (or lower) Loan Repayment Levies, but this will be offset by the increase (decrease) in loan repayments from the OC/BC to each SFO.

In summary, a change in interest rate makes no practical difference to SFOs.

If any lot/unit owner is late in paying its levies, regardless of whether the levies are Administration Levies, Capital Works Levies or Loan Repayment Levies, the OC/BC has many remedies available to it, including but not limited to charging interest on overdue amounts, taking enforcement action to recover the debt and if required ultimately seeking a judgment from the court to take possession and seek to have the lot/unit owner’s apartment sold, from which the outstanding levies are recovered from the sale proceeds.

The Working Capital Facility offered by Austrata can provide additional short-term funding to the OC/BC to cover any cash shortfalls arising from loan repayment levies not being paid on time.

The key loan terms are stipulated in the loan documentation, including:

- interest rate,

- length of loan,

- repayment frequency etc.

The rights of Austrata and of the SFOs in the event of default on the loans is stipulated in the loan contract, noting that Austrata and the SFOs rank equally in their claims against the OC/BC.

The SFO loan is between the entity that owns the lot/unit (you as an individual/s, company, trust etc) and the OC/BC, nothing is noted against the lot/unit.

In any event, the SFO loan is an asset and not a liability.

© Austrata Finance Pty Ltd

ABN 88 646 360 796

Australian Credit Licence No. 528856